PM-Vidyalaxmi Scheme: The Government of India has introduced the PM-Vidyalaxmi Scheme to ensure that no deserving student is deprived of higher education due to financial constraints. This innovative initiative provides collateral-free and guarantor-free education loans to meritorious students seeking admission to the top 860 higher educational institutions in India.

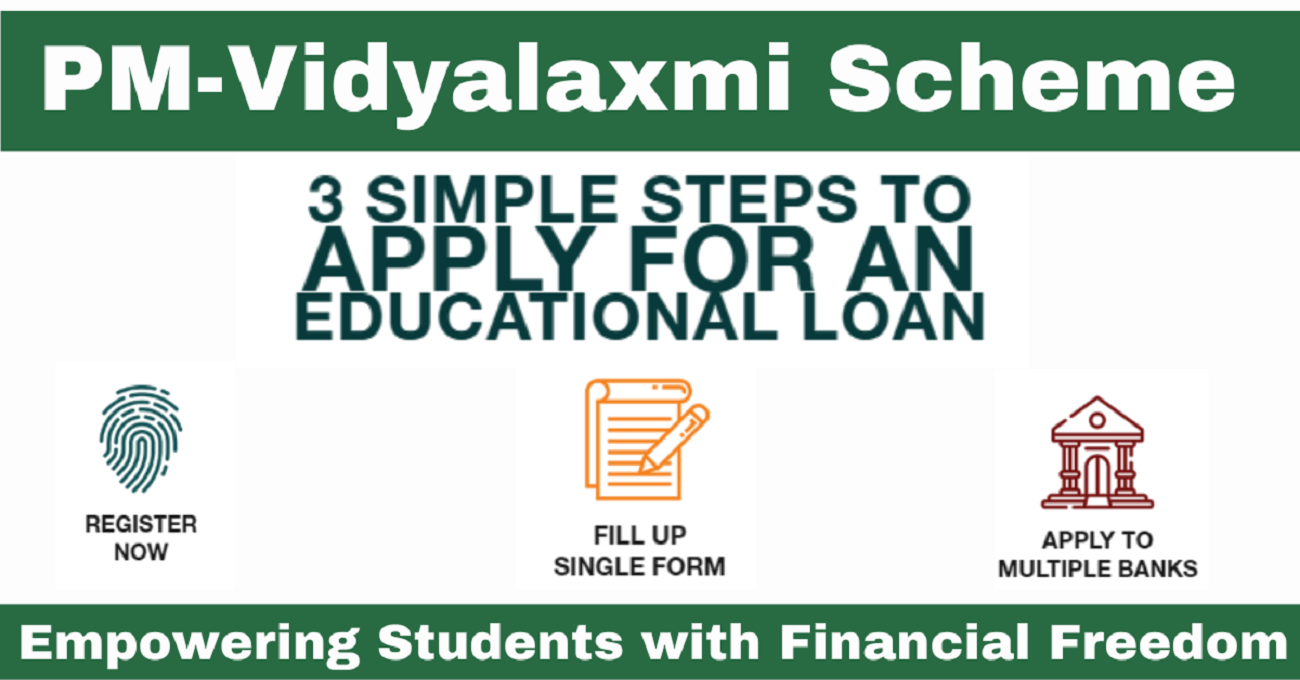

With a transparent, student-friendly, and entirely digital application process, the scheme is designed to make higher education accessible for every aspiring learner.

PM-Vidyalaxmi Scheme Key Features

- Collateral-Free Loans: Students can avail of education loans without needing any collateral or guarantor.

- Interest Subvention: For students with an annual family income of up to Rs. 8 lakhs, the scheme offers a 3% interest subvention on loans up to Rs. 10 lakh.

- Top Institutions Covered: Loans are available for students admitted to 860 quality higher educational institutions in India.

- Digital Application Process: The process is completely digital, ensuring ease and transparency for applicants.

To check the list of 860 higher education institutions, visit: dashboard.aishe.gov.in

Guidelines and Grievance Redressal for PM-Vidyalaxmi Scheme Key Features

The detailed guidelines for the PM-Vidyalaxmi Scheme are available for download. For grievances related to the PM-Vidyalaxmi Scheme or the Central Sector Interest Subsidy (CSIS), students can contact:

- Canara Bank

- Phone: 080-22533876

- Email: hoel@canarabank.com, hogps@canarabank.com

Central Sector Interest Subsidy Scheme (CSIS)

Implemented in 2009 by the Department of Higher Education, Ministry of Education, the CSIS Scheme provides interest subsidies during the moratorium period (course duration plus one year). Students from economically weaker sections with an annual parental income of up to Rs. 4.5 lakh can benefit from this scheme for loans taken under the Indian Banks Association’s Model Education Loan Scheme.

Eligibility Criteria for CSIS

- Applicable for professional and technical courses only.

- Courses must be from NAAC or NBA-accredited institutions, Institutions of National Importance, or Centrally Funded Technical Institutions (CFTIs).

- Canara Bank serves as the Nodal Bank for the scheme’s implementation.

How CSIS Works

The bank sanctioning the education loan uploads the claim for interest subsidy on the Canara Bank portal. The subsidy is credited directly to the student’s loan account via Direct Benefit Transfer (DBT) through the Public Financial Management System (PFMS).

Increased Loan Limit

Since the 2022-23 academic year, the ceiling for educational loans has been increased to Rs. 10 lakh. For more information, visit the official Canara Bank CSIS Dashboard.

Rs 10 lakh Credit Guarantee Fund Scheme for Education Loans (CGFSEL)

The Credit Guarantee Fund Scheme for Education Loans (CGFSEL), notified in 2015, ensures that students can avail of education loans without collateral or third-party guarantees. Under this scheme, the Central Government provides a guarantee cover of up to 75% of the loan amount for loans up to Rs. 7.5 lakh.

Key Benefits of CGFSEL

- No collateral or third-party guarantee is required for loans up to Rs. 7.5 lakh.

- Guarantee cover is provided through the National Credit Guarantee Trustee Company Ltd. (NCGTC).

- The bank handles all necessary paperwork for the credit guarantee.

For more details about CGFSEL, visit: www.ncgtc.in

Additional Resources in PM-Vidyalaxmi Scheme

FAQs about the PM-Vidyalaxmi Scheme

- Who can apply for the PM-Vidyalaxmi Scheme? Meritorious students seeking admission to the top 860 higher educational institutions in India can apply.

- What is the annual income limit for interest subvention? Students with a yearly family income of up to Rs. 8 lakhs are eligible for 3% interest subvention.

- What is the maximum loan amount covered under the CSIS? Loans up to Rs. 10 lakh are covered under the CSIS.

- What is the role of Canara Bank in these schemes? Canara Bank is the Nodal Bank responsible for implementing CSIS and related grievance redressal.

- Where can I find detailed guidelines for these schemes? Guidelines are available for download on the respective scheme portals linked in this blog.

For Apply Dr. A.P.J. Abdul Kalam Young Research Fellowship 2024-25 Click Here